Let’s start with a story. Imagine a new restaurant opens up in your town. From day one, it’s a huge hit. Every night, the tables are full, the music is buzzing, and people are posting rave reviews online. The owners are seen around town, smiling and happy. Everyone thinks they must be making a fortune. You probably think to yourself, “Wow, they’re so successful.”

Then, three months later, something strange happens. You drive by, and there’s a simple, handwritten “Closed” sign taped to the front door. The lights are off. The buzz is gone. You’re confused. How could a place that was so busy and popular just disappear?

The answer is a secret that every successful business owner knows, and it’s the number one reason why so many passionate, hardworking people have to close their doors. The restaurant was probably profitable on paper. They were selling a lot of food and bringing in a lot of revenue. But they ran into the silent killer of small businesses: they ran out of cash. Maybe they had to pay their food suppliers for a massive order before their customers’ credit card payments actually hit their bank account. Maybe they had to make payroll for their staff, but a big catering client hadn’t paid their bill yet. Even though they were “making money,” they didn’t have the actual cash on hand to pay their own bills. And so, the dream was over.

This single, crucial difference—between having “profit” and having “cash”—is what we’re going to talk about today. Because once you understand it, you can protect your business from this all-too-common fate.

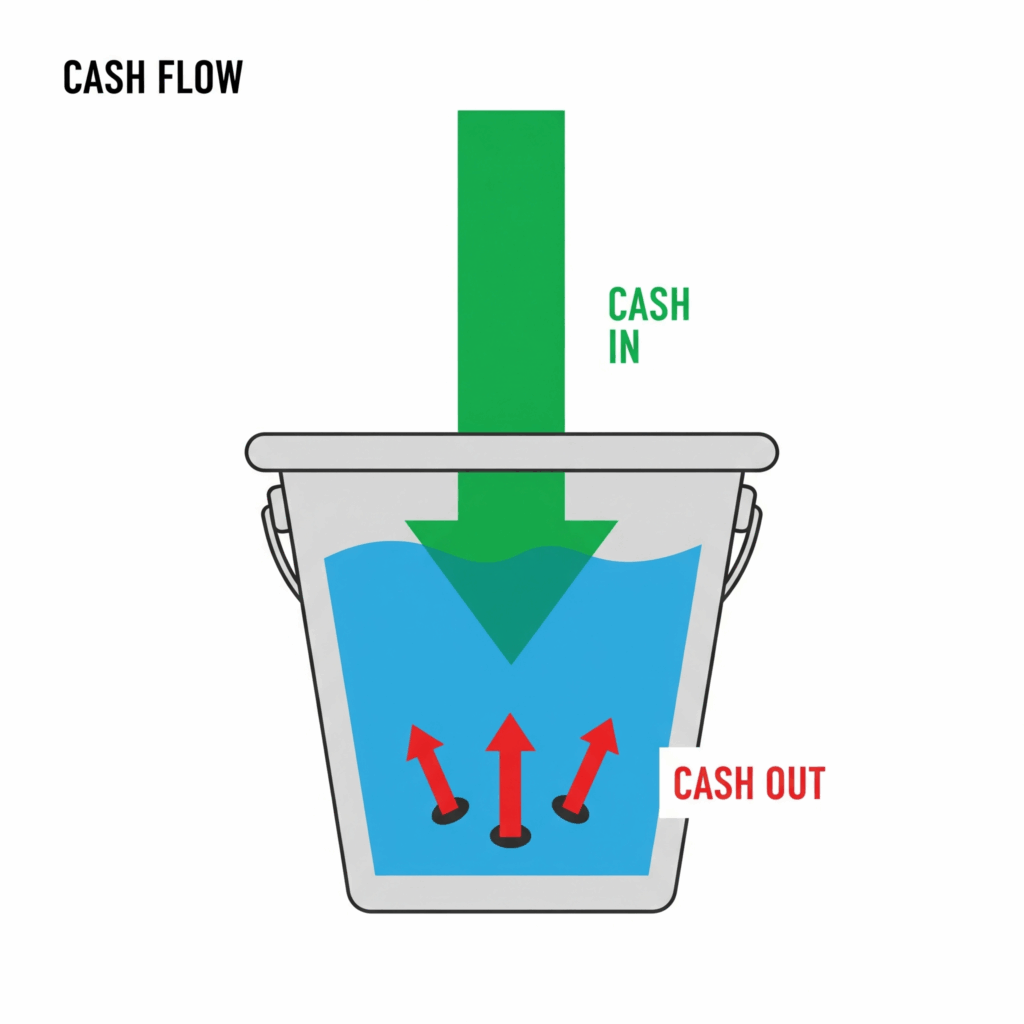

So, What is Cash Flow, Really? (The Bucket Analogy)

Forget about complicated accounting terms for a minute. Let’s think about cash flow in the simplest way possible.

Imagine your business is a big bucket.

Cash In (Inflow) is the water coming into your bucket from a hose. This is every single dollar of real, actual money that lands in your business bank account. It’s when a customer pays you for a product, when a client’s payment for your service clears, or when you get a deposit from a loan. It’s the money you can actually spend.

Cash Out (Outflow) is all the little leaks and holes in your bucket where water drains out. This is every dollar you spend to keep your business running. It’s the money you use to pay your rent, your employees’ wages, your internet bill, the cost of supplies, your taxes, and that software you signed up for last month.

Your Cash Balance is the actual amount of water in the bucket at any given moment.

Your entire job as the master of your business’s finances is simple: make sure the water level in your bucket never, ever hits zero. You need to keep the hose filling the bucket at a rate that is faster than the leaks are draining it.

You could have promises of a lot of water coming soon (like unpaid invoices from clients), but if the bucket is empty today, you can’t pay for the water you need to stay in business. Sales figures are great, and profit margins are important, but cash is the oxygen your business breathes. Without it, nothing else matters. This guide will give you a simple, stress-free way to become the master of your cash flow, whether you’re a freelance writer, a coffee shop owner, or you run a small engine repair shop in Conneaut, Ohio.

Know Your Flow: How to See Your Cash Clearly

The first step to controlling your cash flow is simply to watch it. Many business owners are afraid to look at their numbers. They think it’s going to be complicated or that they need to be a math genius. The truth is, you don’t. You just need to be willing to look. Creating a cash flow tracker is easier than you think, and it will give you a superpower: the ability to see the future of your business.

Don’t Be Afraid of the “Statement”

When you hear the term “Cash Flow Statement,” it sounds like a scary official document that only an accountant can create. Let’s throw that idea out the window. For our purposes, a cash flow statement is just a simple list that answers two questions every day or every week: “Where did money come from?” and “Where did my money go?” That’s it. It’s your business’s diary, written in dollars and cents. By reading this diary, you’ll understand the rhythm of your business, which will help you make smarter decisions and avoid nasty surprises.

Your First Cash Flow Tracker: A Step-by-Step Guide

You can do this with a simple spreadsheet using a program like Google Sheets (which is free) or Microsoft Excel. Let’s build one together right now. Open a new spreadsheet and create five columns.

- Column A: Date: The day the money moved.

- Column B: Description: A short note on what the transaction was for (e.g., “Payment from Client Jane Doe,” “Rent Payment,” “Office Supplies”).

- Column C: Money In (+): For any cash that came into your bank account.

- Column D: Money Out (-): For any cash that left your bank account.

- Column E: Balance: The total amount of cash you have at the end of the day.

Now, here’s how to use it:

- Step 1: Your Starting Balance. In the very first row, put today’s date and in the “Description” column, write “Starting Balance.” Then, in the “Balance” column (Column E), put the total amount of cash you have in your business bank account right now. Let’s say it’s $5,000.

- Step 2: Tracking “Money In”. Every time you get paid, add a new row. Let’s say tomorrow, a client pays you $500. You’ll add a new row with tomorrow’s date, a description like “Payment from Client A,” and put $500 in the “Money In” column.

- Step 3: Tracking “Money Out”. Every time you spend money, add a new row. Let’s say on that same day, you buy $50 worth of supplies. You’ll add another row with that date, a description like “Supplies from store,” and put $50 in the “Money Out” column.

- Step 4: The Running Balance. This is where the magic happens. At the end of each day, you’ll calculate your new balance. The formula is simple:

Previous Day's Balance + Today's Money In - Today's Money Out = Today's Closing BalanceSo, in our example:$5,000 + $500 - $50 = $5,450. Your new balance at the end of the day is $5,450. You’ll put that in the “Balance” column for that day. You keep doing this every day, and you will have a perfect picture of the flow of cash in your business.

Looking at the Past, Predicting the Future

After you’ve tracked your cash flow for a month or two, you’ll start to see patterns. You might notice that the first week of the month is always a bit slow for sales, or that you always have a big payment for supplies due on the 15th. This information is gold.

Now you can create a simple Cash Flow Forecast. This is just an educated guess about what your cash flow will look like next month or the month after. It’s not about having a perfect crystal ball; it’s about avoiding surprises.

For example, if you look at your forecast and see that your cash balance is likely to dip very low around the 20th of next month because you have a big bill due and a client who usually pays late, you’re no longer in the dark. You can take action now. You could push extra hard for a few sales before then, or maybe you could call that client and offer them a small discount if they pay their bill early. Suddenly, you’re not reacting to problems; you’re solving them before they even happen. This simple habit of tracking and forecasting is the first and most important step to becoming the true master of your business’s finances.

The “Money In” Problem: How to Get Paid Faster

You’ve finished a big project for a client. You did an amazing job, they love the result, and you send them an invoice for your hard work. On paper, you’ve just made a lot of money! But here’s the problem: your rent is due next week, and the client has 30 days to pay your invoice. The money you earned isn’t actually in your bank account yet. It’s just a promise.

This “waiting game” is one of the biggest sources of stress for small business owners.1 Even profitable businesses can fail if their cash is tied up in unpaid invoices.2 Remember our bucket analogy? An unpaid invoice is like a promise that someone will bring you a big jug of water later. But if your bucket is empty now, that promise won’t help you. Your goal should be to shorten the time between doing the work and getting the cash in your hand. Here are five simple tricks to speed up your cash inflow.

- Trick 1: Invoice Immediately and Clearly.This seems obvious, but many business owners get busy and put off invoicing. They might finish a job on a Tuesday and not send the invoice until the following Monday. This just starts the payment clock a week later for no good reason. Make it a rule for your business: the moment the work is complete or the product is delivered, the invoice is sent. Don’t wait.Also, make sure your invoice is crystal clear. It should have the invoice number, the date, a clear description of the work you did, the total amount due, and a very obvious due date. If an invoice is confusing, it gives the client an excuse to put it aside to “figure out later.”

- Trick 2: Make Paying You Effortless.Think about how easy it is to buy something on Amazon with one click. You want to make paying your invoices just as simple. The more steps a client has to take to pay you, the more likely they are to procrastinate. If they have to find their checkbook, write a check, find an envelope, find a stamp, and mail it to you, it could take them weeks to get around to it.Use an online accounting or invoicing software like QuickBooks, FreshBooks, Wave, or Stripe. These tools let you send professional invoices via email with a big, friendly “Pay Now” button right in the email. The client can click it and pay instantly with a credit card or bank transfer. This one change can cut your payment times in half.

- Trick 3: Get Money Upfront (Deposits).For any large project, custom order, or new client, it’s a smart business practice to require a deposit before you begin any work. This is usually between 25% and 50% of the total project cost.Getting a deposit does two wonderful things for your cash flow. First, it gives you immediate cash to cover any initial costs you might have for the project, like buying materials. Second, it ensures the client is serious and committed. A client who has paid a deposit is much less likely to change their mind or disappear halfway through the project. It’s a sign of a professional partnership.

- Trick 4: Offer a “Carrot” for Early Payments.People love a good deal. You can use this to your advantage by offering a small discount if a client pays their invoice early. This is a common practice in many industries. You might see terms on an invoice like “2/10, n/30.” This sounds like complicated accounting code, but it’s very simple. It just means the client can take a 2% discount if they pay the invoice within 10 days; otherwise, the full (net) amount is due in 30 days.For a $1,000 invoice, that’s a $20 discount for the client. That might be enough to motivate them to pay you right away instead of waiting a month. You lose a tiny bit of profit, but you get your cash in the bank immediately, which is often much more valuable.

- Trick 5: Automate Your Reminders.Nobody likes being a nag. Constantly calling or emailing clients to ask for money is awkward and uncomfortable. Luckily, you can let technology be the “bad guy” for you. Most modern invoicing software allows you to set up automated payment reminders.3 You can set it up to send a polite, friendly email to the client a few days before the due date, on the due date, and a few days after if the payment is late. These reminders are professional, they never forget, and they take the emotion out of the process for you. This simple automation can dramatically reduce the number of late payments you have to deal with.

The “Money Out” Problem: How to Manage Your Leaks

Controlling your cash flow isn’t just about getting money in faster; it’s also about being smart about how money goes out. Remember the leaks in our bucket? Your job is to make sure those leaks are as small and as controlled as possible. Many business owners are so focused on sales that they don’t pay close attention to their expenses. But small, hidden drips can add up to a huge drain on your cash over time.

The “Expense Audit”: A Monthly Ritual for a Healthy Business

You don’t need to become a penny-pincher who reuses paper clips. You just need to be mindful. A great way to do this is to set aside one hour, once a month, to do a quick “Expense Audit.” It’s a simple ritual that can save you a surprising amount of money. Just print out your business bank account and credit card statements from the last month and go through them with a highlighter.

Look for these common cash drains:

- Category 1: The “Subscription Creep”.We live in a world of subscriptions. We sign up for a free trial of a new software tool, we subscribe to a service we think we’ll use, and we forget all about it. Before you know it, you could be paying for five different software tools when you only really use two of them. That $20 here and $50 there adds up to hundreds or even thousands of dollars a year.As you go through your statement, highlight every recurring subscription payment. For each one, ask yourself three questions:

- “Did I actually use this last month?”

- “Did it provide real value to my business?”

- “Is there a cheaper or free alternative that does the same thing?” Be ruthless. If you’re not using it, cancel it. That’s cash that can go straight back into your bucket.

- Category 2: Your Suppliers and Vendors.The price you pay for your supplies isn’t always set in stone. Many business owners just accept the first price they are given and never think to ask for a better deal.Make it a habit to review your biggest suppliers once or twice a year. Call them up and have a friendly conversation. You can ask things like:

- “Is there a discount available if I pay my bills early?”

- “If I buy in a slightly larger quantity, can I get a better per-unit price?”

- “I’m trying to manage my costs. Are there any promotions you have coming up that I should know about?” The worst they can say is no. But often, they are willing to work with good, loyal customers to keep their business. It never hurts to ask.

- Category 3: Differentiating “Needs” vs. “Wants”.When you’re running a business, it’s easy to get excited about having the best of everything. But to protect your cash flow, especially when you’re starting out, you need to be honest about what is a true “need” versus what is just a “want.”For example: You need a reliable computer to run your business. You might want the brand-new, top-of-the-line MacBook Pro with all the bells and whistles, but maybe a solid, less expensive Dell laptop will do the job just as well for half the price. You need a space to work. You might want a fancy office in the trendiest part of town, but maybe a more affordable co-working space or even a dedicated home office is a smarter financial move for now. Adopting a “lean” mindset helps you focus your cash on things that directly help you serve customers and grow.

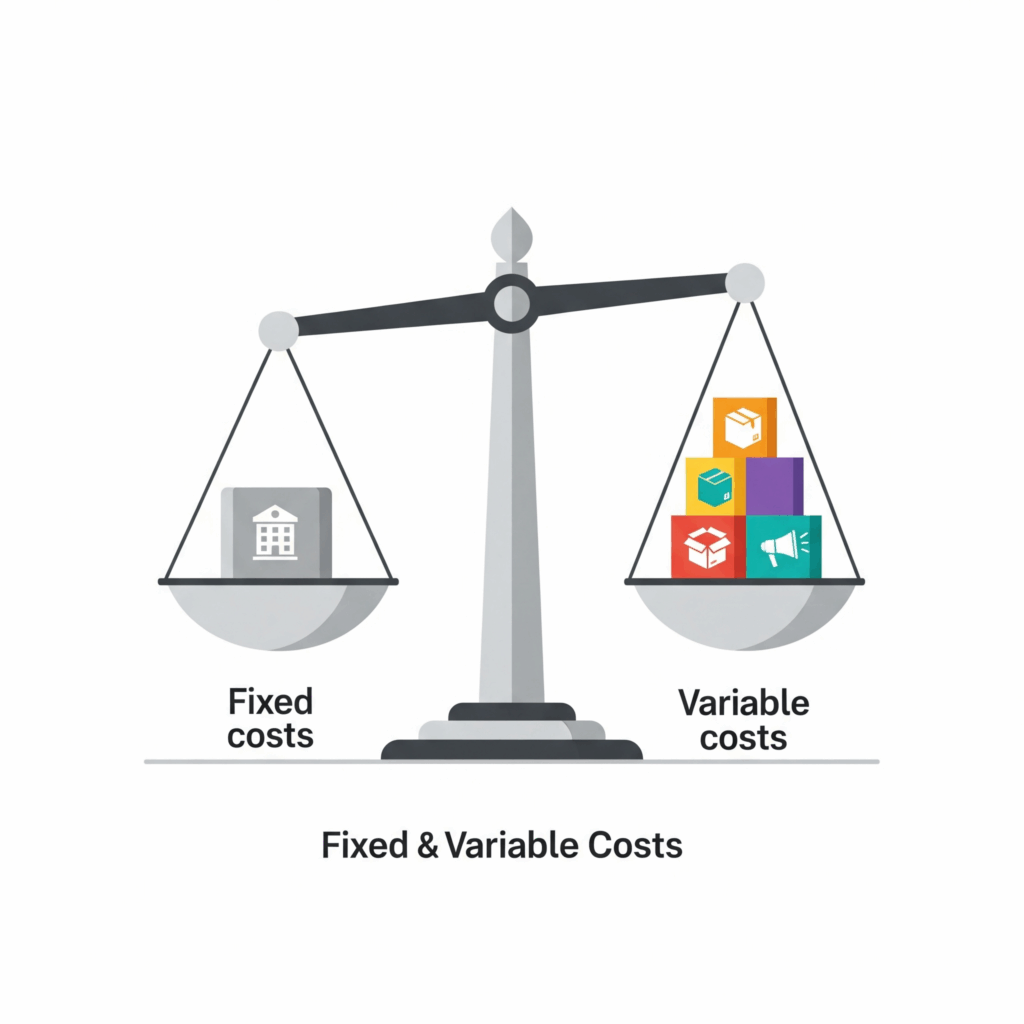

Understanding Your Costs: Fixed vs. Variable

One last powerful concept for managing your expenses is understanding the difference between your fixed and variable costs.

- Fixed Costs: These are the bills you have to pay every single month, no matter how much you sell.4 Think of them as the predictable leaks in your bucket. This includes your rent, insurance payments, loan payments, and salaries for your permanent staff.

- Variable Costs: These are the costs that go up or down depending on how busy you are.5 This includes things like raw materials for your products, shipping costs, or how much you spend on online advertising.

Why does this matter? Because in a slow month, you can’t do much about your fixed costs; you still have to pay the rent. But you have a lot of control over your variable costs. If sales are slow, you can decide to spend less on advertising that month, or buy fewer raw materials. Knowing which financial “levers” you can pull gives you the power to protect your cash when business is slow.

Your Secret Weapon: Building a Cash Cushion

Life is unpredictable. Business is even more unpredictable. No matter how well you plan, unexpected things will happen. A key piece of equipment will suddenly break. A huge snowstorm might shut down your shop for a week. A major client who provides 25% of your income could go out of business.

These events can be fatal for a small business that is living payment-to-payment. This is why building a cash reserve—a “cushion” or a business emergency fund—is one of the smartest things you can do. A cash cushion gives you the ability to survive these shocks without going into a panic, taking on expensive debt, or having to close your doors.6

How Much is Enough?

The standard advice for a healthy business cash reserve is to have 3 to 6 months of essential operating expenses saved up.

Don’t let that big number scare you. Let’s break it down. First, figure out your essential monthly expenses. Look at your “Money Out” list and add up all the things you absolutely must pay each month to keep the lights on. This includes your rent, your payroll, your utilities, your insurance, and any loan payments. Let’s say that number is $4,000 per month.

Your first goal would be to save up 3 months’ worth, which would be $4,000 x 3 = $12,000. This is your “peace of mind” fund. This means if something terrible happened and you made zero sales for three straight months, you could still pay your most important bills and survive.

How to Build It, One Drop at a Time

You don’t have to save this all at once. The key is to start small and be consistent. Think of it like filling up a separate, smaller bucket, one drop at a time.

- Step 1: Open a Separate Business Savings Account. This is crucial. Your cash reserve should not be mixed in with the money you use for daily operations. Open a separate, high-yield savings account at your bank and label it “Business Emergency Fund.”

- Step 2: Automate Your Savings. The easiest way to save is to make it automatic so you don’t even have to think about it. You can set up an automatic transfer from your main business checking account to your new savings account. You could transfer $100 every week, or maybe you could make a rule to transfer 5% of every single client payment you receive.

- Step 3: Be Patient and Consistent. It might take a year or more to reach your 3-month goal, and that’s perfectly okay. The important thing is that you are consistently building your cushion. Every dollar you add to that savings account is another layer of security and freedom for your business.

Think of this fund as buying yourself one of the most valuable things an entrepreneur can have: the ability to make smart, strategic decisions instead of desperate, panicked ones.

Conclusion: You Are Now the Master of Your Money

We’ve covered a lot, but it all comes down to a few simple ideas. Profit is not the same as cash. You need to watch the flow of money in and out of your business. You need to have strategies to get paid faster and be mindful of how you spend. And you need to build a safety net for the unexpected.

Managing your cash flow isn’t a scary, complicated accounting task that only experts can do. It’s a simple, powerful habit of paying attention. It’s about taking the time, just once a week, to look at your bucket. Is the water level rising or falling? Where are the biggest leaks? How can you get the hose to flow a little faster?

By taking these simple steps, you are fundamentally changing your relationship with your business. You are no longer just a passenger, hoping you don’t crash. You are the pilot, with your hands firmly on the controls, looking at the dashboard and making smart decisions to guide your business safely to its destination.

You have the power to build a business that is not just profitable and successful, but also strong, resilient, and built to last for years to come. You are now in control.